Highlight News

World News

Latest News

Editor Picks

Features and Events

Nurturing Preschoolers Essential Parenting Tips for Success

Introduction

Parenting preschoolers can be both rewarding and challenging. As parents, it’s essential to have the right tools and strategies to nurture our little ones and set them up for success. Here are some essential parenting tips for navigating the preschool years with confidence and fostering your child’s growth and development.

Establishing Routines

Preschoolers thrive on routines as they provide predictability and structure in their day-to-day lives. Establishing consistent routines for meals, bedtime, and daily activities can help children feel secure and empowered. Be flexible yet firm in implementing routines, allowing for some variation while maintaining essential elements to provide

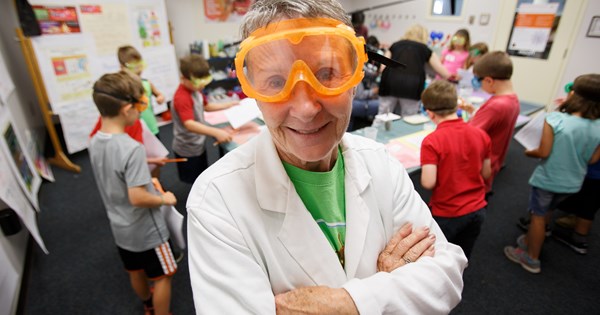

GSK STEM Education Inspiring Tomorrow’s Innovators

Inspiring Innovation: GSK STEM Education

Empowering the Next Generation

In today’s rapidly evolving world, the fields of science, technology, engineering, and mathematics (STEM) play a crucial role in driving innovation and shaping the future. Recognizing the importance of nurturing young talent in these areas, GSK has developed a comprehensive STEM education program aimed at empowering the next generation of scientists, engineers, and innovators.

Fostering Curiosity and Creativity

At the heart of GSK’s STEM education initiatives is a commitment to fostering curiosity and creativity in young minds. Through hands-on activities, interactive experiments, and real-world applications, students are encouraged to explore the

Next-Level Learning Post-10th Computer Programming Courses

Ignite Your Passion for Coding with Post-10th Programming Courses

In the ever-evolving landscape of technology, coding has emerged as a crucial skill set, offering boundless opportunities for innovation and problem-solving. For students looking to embark on a journey into the world of programming, post-10th programming courses present a gateway to unlocking their potential in the digital realm.

Exploring the Foundations: Understanding the Basics

Before delving into the complexities of programming languages and algorithms, it’s essential to grasp the fundamental concepts of coding. Post-10th programming courses often begin with an exploration of these basics, offering students a solid foundation to build

Explore Business Administration Online Courses for Success

Embark on a Journey of Business Excellence

In today’s dynamic business landscape, the importance of strong leadership and effective management cannot be overstated. Whether you’re a seasoned professional looking to enhance your skills or an aspiring entrepreneur eager to dive into the world of business administration, online courses offer a pathway to success. Let’s explore the myriad opportunities presented by online business administration courses and how they can pave the way for personal and professional growth.

The Evolution of Learning: Online Education

Gone are the days when traditional classroom-based learning was the only option for advancing one’s education. With the

AI Tips for SuccessMastering AI: Essential Tips for Success

Introduction

In today’s rapidly evolving technological landscape, mastering AI is essential for professionals across various industries. Whether you’re a seasoned expert or just dipping your toes into the world of artificial intelligence, leveraging essential tips can significantly enhance your success. In this guide, we’ll explore key strategies and insights to help you master AI and thrive in the digital age.

Understanding the Fundamentals

Before delving into advanced AI techniques, it’s crucial to establish a solid understanding of the fundamentals. Familiarize yourself with core concepts such as machine learning, neural networks, and data analysis. Building a strong foundation in AI fundamentals

Self-Care Tips for Educators Prioritize Your Well-Being

Sub Heading: The Importance of Self-Care for Educators

Teaching is undoubtedly a rewarding profession, but it can also be incredibly demanding. As educators, we pour our hearts and souls into our work, often neglecting our own well-being in the process. However, prioritizing self-care is not just a luxury—it’s a necessity. Taking care of ourselves allows us to show up as our best selves in the classroom, better equipped to support and nurture our students. By prioritizing our well-being, we not only benefit ourselves but also create a healthier and more positive learning environment for our students.

Sub Heading: Mindfulness and

Unlock Your Potential Business Analyst Training Online

Exploring the World of Business Analyst Training Online

In today’s fast-paced business landscape, the role of a business analyst is more crucial than ever. With businesses constantly evolving and adapting to market trends, the need for skilled professionals who can analyze data, identify opportunities, and drive strategic decision-making has never been higher. Fortunately, with the availability of business analyst training online, aspiring professionals can unlock their potential and embark on a rewarding career path in this dynamic field.

Convenience and Flexibility

One of the primary advantages of pursuing business analyst training online is the convenience and flexibility it offers. Unlike

Revolutionizing Teaching iRobot Education Root RT1

Exploring Robotics: iRobot Education Root RT1

Revolutionizing Learning with Robotics

The iRobot Education Root RT1 is transforming the landscape of education by introducing students to the world of robotics. This innovative tool combines cutting-edge technology with hands-on learning experiences, providing students with the opportunity to explore STEM concepts in a fun and interactive way. From elementary classrooms to university labs, the Root RT1 is revolutionizing the way students learn and engage with robotics.

Hands-On Learning Experiences

One of the key features of the iRobot Education Root RT1 is its emphasis on hands-on learning experiences. Students have the opportunity to design,

Google’s Impact Advancing STEM Education Worldwide

Advancing STEM Education with Google

Empowering Learners Through Innovation

In the realm of education, particularly in the fields of Science, Technology, Engineering, and Mathematics (STEM), Google has emerged as a leading force driving innovation and transformation. Through a myriad of initiatives, tools, and resources, Google is empowering learners of all ages to explore, discover, and excel in STEM fields, paving the way for a future generation of innovators and problem solvers.

A Digital Learning Revolution

Google’s impact on STEM education can be seen in its commitment to revolutionizing learning through digital technology. By providing access to a wealth of online

Connect Across Generations Online Grandparent Classes

Embracing the Digital Era: Grandparent Classes Online

Connecting Generations Through Technology

In today’s fast-paced world, technology has become an integral part of our daily lives, revolutionizing the way we communicate, learn, and connect with one another. For grandparents seeking to stay engaged with their families and embrace the digital era, online grandparent classes offer a unique opportunity to bridge the generation gap and foster meaningful connections with their loved ones.

Empowering Grandparents with Digital Skills

Many grandparents may feel intimidated by the rapidly evolving landscape of technology, but online grandparent classes provide a supportive environment for them to learn and