Highlight News

World News

Latest News

Editor Picks

Features and Events

Supporting Pregnant Teens Creating a Safe Home Environment

Supporting Pregnant Teens: Creating a Safe Home Environment

Understanding the Importance of Home for Pregnant Teens

For pregnant teenagers, the home environment plays a crucial role in their well-being and the well-being of their unborn child. Creating a safe and supportive home environment is essential to ensure that pregnant teens feel nurtured, empowered, and prepared for the journey ahead.

Providing Emotional Support

Emotional support is paramount for pregnant teens, and the home should be a place where they feel understood, valued, and supported. Family members, caregivers, and friends can offer encouragement, empathy, and a listening ear to help alleviate stress

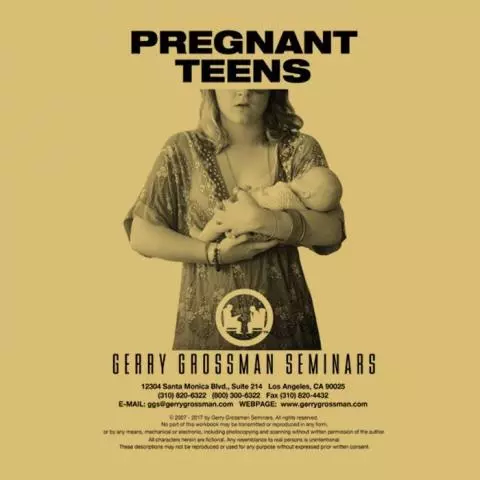

Nurturing Growth The Role of Educator-Parental Collaboration

Navigating the Role of Educator-Parental Dynamics

In the intricate web of education, the relationship between educators and parents plays a pivotal role. Let’s delve into this dynamic alliance and its profound impact on a child’s learning journey.

The Fusion of Roles: Balancing Act or Juggling Act?

Educators often find themselves straddling the line between professional responsibility and a more nurturing, parental role. This fusion of roles can be both enriching and challenging, requiring a delicate balance to meet the diverse needs of students.

Communication: The Backbone of Collaboration

Effective communication serves as the cornerstone of successful educator-parent partnerships. Transparent dialogue

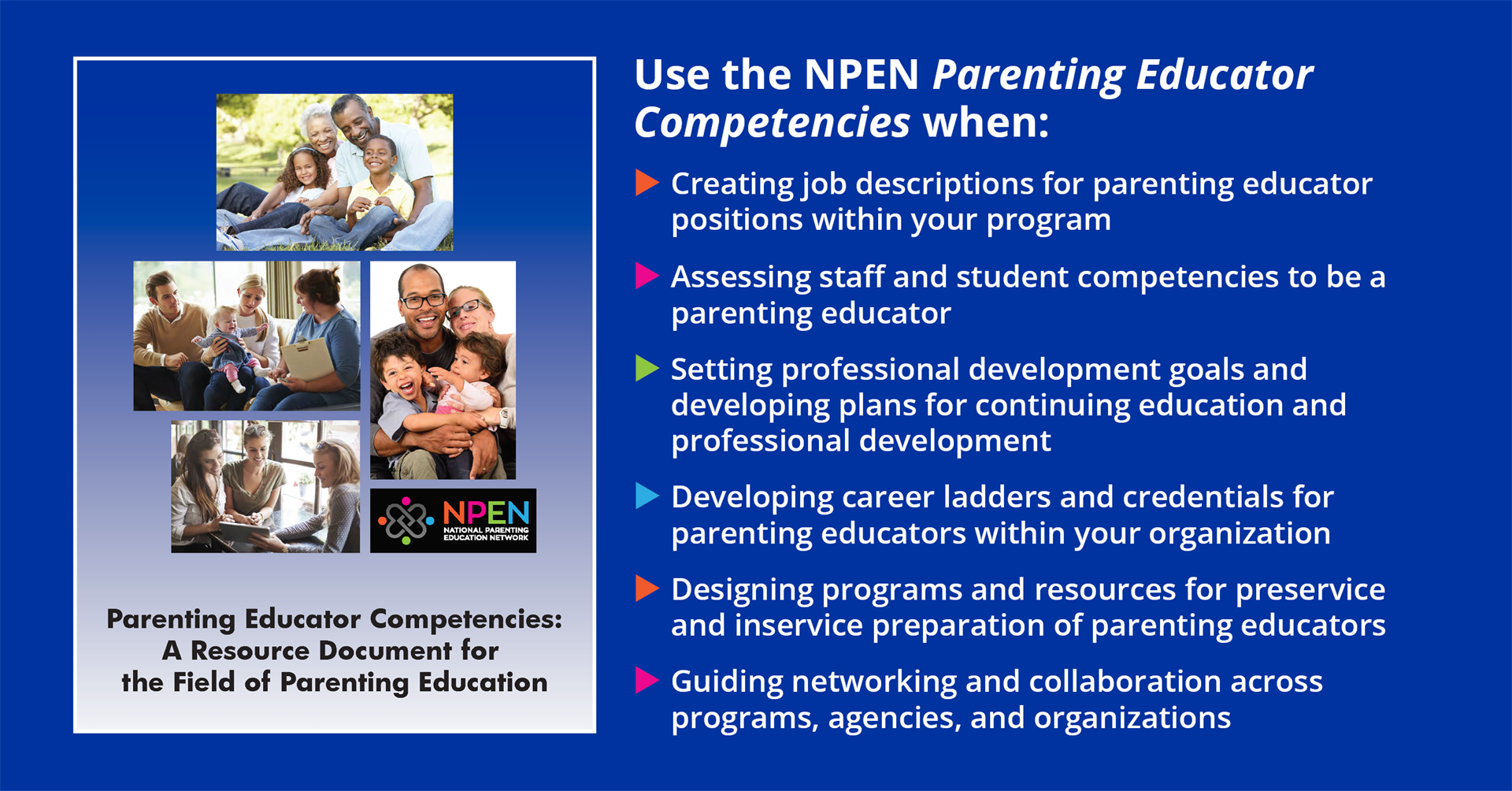

Fostering Innovation Global STEM Education Initiatives

Fostering Innovation: Global STEM Education Initiatives

Empowering Tomorrow’s Leaders

In the dynamic landscape of global education, STEM (Science, Technology, Engineering, and Mathematics) initiatives have emerged as catalysts for change, empowering tomorrow’s leaders with the skills and knowledge they need to thrive in an increasingly complex world. From grassroots community programs to multinational partnerships, global STEM education initiatives are shaping the next generation of innovators, problem solvers, and changemakers.

Driving Progress Through Collaboration

At the heart of global STEM education initiatives lies a spirit of collaboration and cooperation. Across borders and boundaries, educators, policymakers, industry leaders, and community stakeholders come together

Master Coding Professional Development for Teachers

Empower Educators with Coding Courses

Bridging the Digital Divide

In today’s rapidly evolving technological landscape, the role of educators has expanded beyond traditional teaching methods. With the increasing importance of digital literacy, coding courses for teachers serve as a bridge, empowering educators to effectively navigate and incorporate technology into their classrooms.

Elevating Teaching Practices

Coding courses for teachers are not just about learning to code; they’re about elevating teaching practices to meet the demands of the 21st-century classroom. By integrating coding into their curriculum, educators can enhance student engagement, foster critical thinking skills, and prepare students for future success in

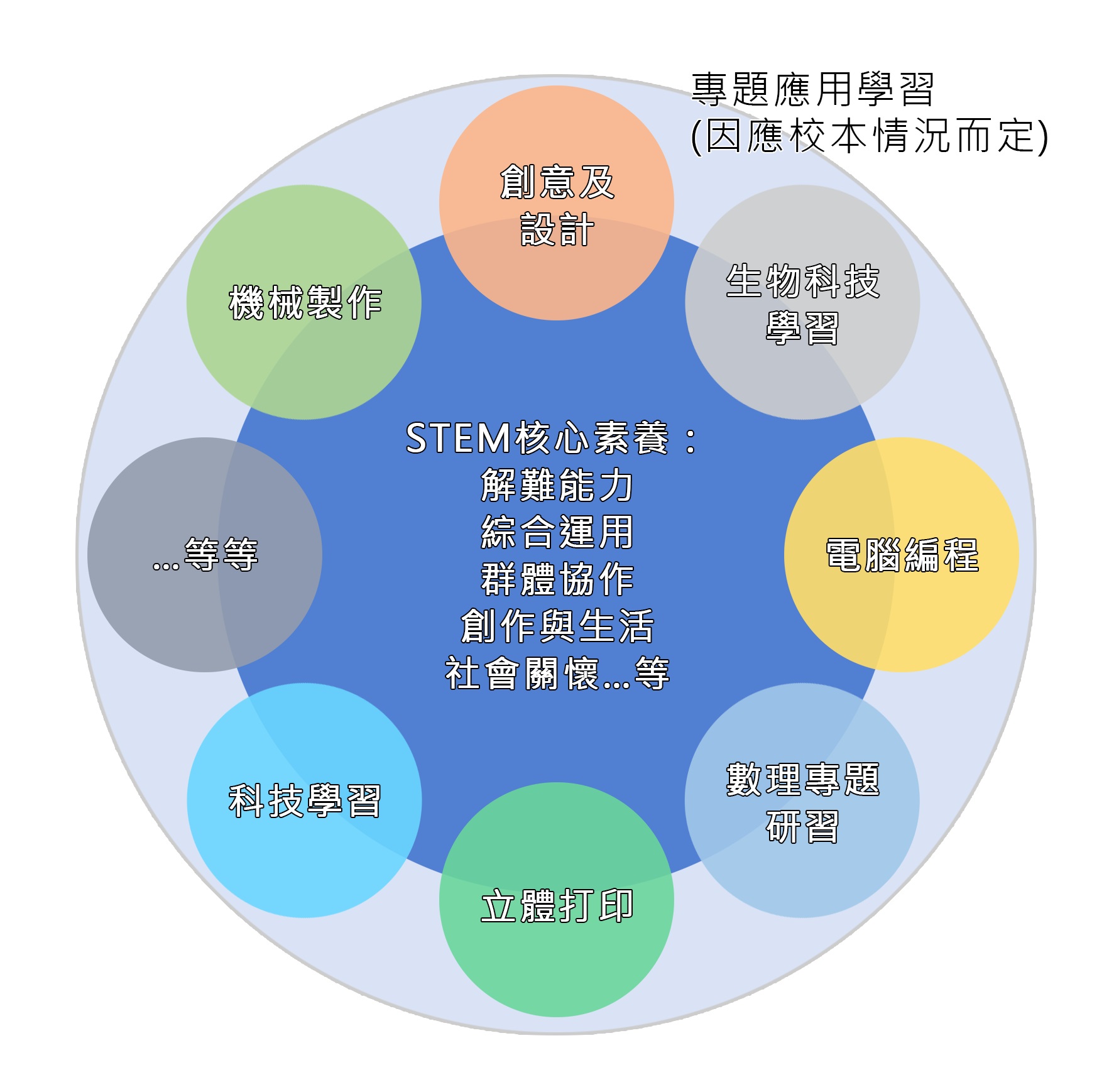

Unveiling STEM Introducing Exciting Learning to Students

Unveiling STEM: Introducing Exciting Learning to Students

Understanding the Essence of STEM

Introducing STEM to students marks a significant shift in educational approaches. STEM encompasses Science, Technology, Engineering, and Mathematics, offering a holistic learning experience that prepares students for the challenges of the modern world. This integration of disciplines fosters critical thinking, problem-solving skills, and innovation from an early age.

Inspiring Curiosity and Exploration

One of the primary goals of introducing STEM to students is to spark curiosity and foster a sense of exploration. By engaging in hands-on activities, experiments, and projects, students develop a passion for learning and a

Exploring Educational Surrogate A New Learning Paradigm

The Rise of Educational Surrogate: Revolutionizing Learning

Understanding the Concept

Educational surrogate, a term buzzing in the educational sphere, signifies a paradigm shift in the way we approach learning. It encapsulates the idea of utilizing technology and innovative methodologies to enhance the learning experience beyond traditional classroom boundaries. The concept revolves around the idea of providing learners with personalized, interactive, and engaging educational experiences tailored to their individual needs and preferences.

Breaking Down the Benefits

One of the primary benefits of educational surrogate is its ability to cater to diverse learning styles and preferences. By offering personalized learning paths and

CoParenter App Revolutionizing Co-Parenting Dynamics

Transforming Co-Parenting Dynamics with Coparenter

Navigating co-parenting dynamics can be a challenging journey filled with emotions, conflicts, and uncertainties. However, with the advent of innovative tools like Coparenter, parents now have the opportunity to streamline communication, manage schedules, and foster collaboration for the well-being of their children.

Streamlining Communication: The Key to Effective Co-Parenting

Communication lies at the heart of successful co-parenting, and Coparenter serves as a powerful platform for facilitating clear and constructive communication between parents. Through features like messaging and journaling, parents can exchange important information, coordinate schedules, and discuss co-parenting matters in a transparent and organized manner.

Magda Gerber’s Approach Respecting Parenting Choices

Subheading: Understanding Magda Gerber’s Approach to Respectful Parenting

Magda Gerber, a pioneer in the field of early childhood education, revolutionized parenting with her philosophy rooted in respect and empathy. Her approach, known as Resources for Infant Educarers (RIE), emphasizes treating infants and young children as capable individuals deserving of respect and autonomy.

Subheading: Fostering Independence

Central to Gerber’s philosophy is the belief in fostering independence from the earliest stages of life. Rather than hovering over children or constantly intervening in their activities, Gerber encouraged parents to trust their children’s innate abilities and provide them with the space and freedom to

Fostering Diversity Inclusive STEM Education Initiatives

Fostering Diversity: Inclusive STEM Education Initiatives

The Importance of Inclusive STEM Education

Inclusive STEM education is essential for ensuring that all students have equal opportunities to succeed in science, technology, engineering, and mathematics. By promoting diversity and equity in STEM fields, we can create a more inclusive and innovative workforce that reflects the rich diversity of our society.

Challenges in STEM Education

Despite the importance of inclusivity, STEM education faces several challenges, including a lack of diversity in STEM fields, gender and racial disparities, and systemic barriers that prevent underrepresented groups from pursuing STEM careers. Addressing these challenges requires a

Dive Into STEM Igniting Curiosity in Science Education

Igniting Curiosity in Science Education

In today’s rapidly advancing world, the importance of STEM (Science, Technology, Engineering, and Mathematics) education cannot be overstated. It serves as the cornerstone for preparing the next generation of innovators, problem solvers, and critical thinkers. Through immersive learning experiences and hands-on activities, STEM education ignites curiosity and fosters a deep appreciation for the wonders of science.

Empowering Minds for Tomorrow

STEM education goes beyond the traditional classroom setting, empowering young minds to explore, question, and experiment. By engaging students in real-world challenges and projects, educators cultivate essential skills such as creativity, collaboration, and resilience. These